Before diving into what I'm investing in for a post peak oil world, in this post I outline investments to avoid that may surprise many peak oilers. To be clear, it's not that there isn't money to be made buying these assets or even that they won't outperform. It's that they would need to be traded in a very volatile and dynamic time in history. In my opinion only the most nimble of traders would be able to navigate the risks I see in these assets. I prefer to focus on 2nd and 3rd order assets that will outperform in a peak oil world via a buy and hold portfolio.

Oil Majors:

One of the first investments people think of after reading about Peak Oil is oil producing companies. And why not? Peak Oil will lead to spiking crude oil prices which will benefit those companies who produce it. But there are hidden risks that I believe will make any potential rewards from buying Oil Majors not worth it as a buy and hold.

There's a risk that crude oil prices do not stay especially elevated. Energy prices require two simultaneous things: 1) high enough so that it stays profitable to keep drilling for more remote and ever lower EROI fields. 2) low enough that consumers around the world can afford it. There’s a distinct possibility in the near future where these two economic states rarely sync and a lot of the oil is simply abandoned.

Another risk is politics and resource nationalization. ...

And finally, resource depletion risk. A great quote: "An oil company can only exist if it has reserves and is able to keep production at targeted levels for a long period of time. If reserves and production dwindle, it is not only the attractiveness of such an independent oil company that comes into question but its existence." Yes, a lot of the majors will attempt pivots to renewable energy. But now you're investing in renewable energy via proxy. Is it possible they succeed? Of course. But if I want to invest in renewable energy, I will do so directly.

Precious Metals Miners:

The thesis (admittedly broad brushstrokes) goes something like this: Peak Oil will lead to financial instability and potential currency/debt collapse. Gold and silver will outperform when confidence in the financial system falls. By investing in gold & silver miners you gain leverage to the metal's price due to proven resources in the ground. Bonus points of collecting dividends while you hold. While I can get behind having some exposure to the metals themselves, I believe the miners will underperform.

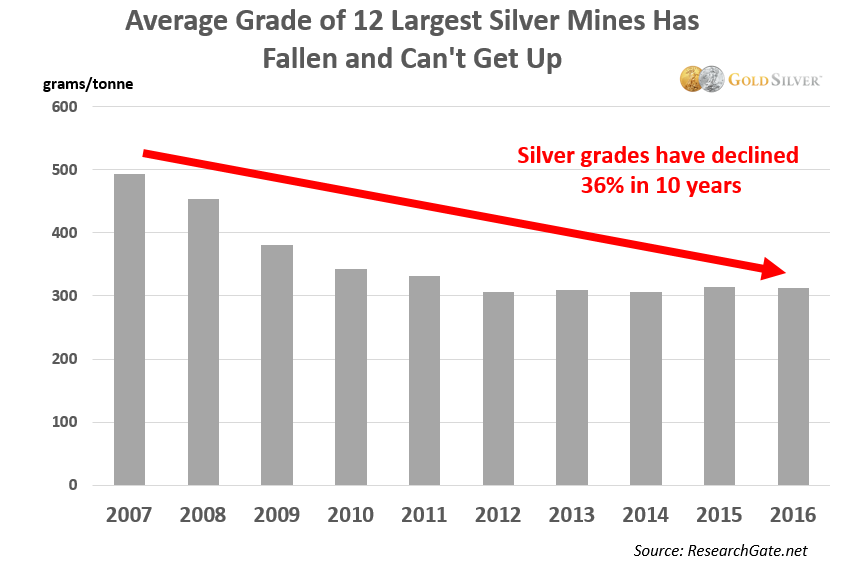

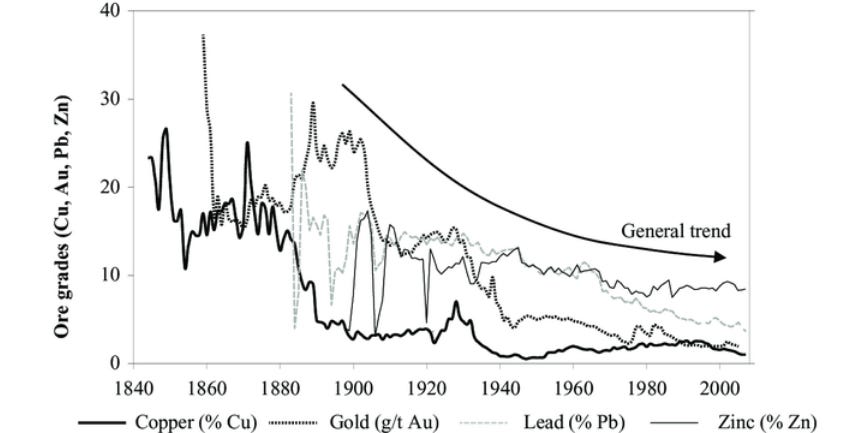

Mining and processing is a very energy intensive operation that is only becoming more intensive as ore grades decline. In times of high energy prices, mining margins can shrink substantially or even go negative if the price of the metals does not significantly rally. Additionally, energy supply disruptions (independent of price) can bring production to a halt even in the face of skyrocketing metal prices. I’d want to avoid any energy intensive industry in the face of Peak Oil, mining included.

This was my first post on investing in a Peak Oil world. I believe to succeed in this new reality will require careful and deep thought on the 2nd and 3rd order effects of Peak Oil including the political and geo-political reactions of world governments. Simply plowing one’s entire 401k into $XOM and calling it a day will not work. If you enjoyed this post please subscribe by clicking below.